If you are searching for reputational risk examples, you are probably trying to avoid the kind of surprise that does not show up in a spreadsheet until it is too late. A relationship can look fine on paper, then a hidden controversy turns into your problem, your headline, and your internal fire drill.

Reputational risk is the loss of trust that happens when a company’s actions, people, or associations make stakeholders think less of you. That trust loss can quickly become real harm, like lost customers, stalled deals, nervous investors, employee churn, and tougher scrutiny from regulators. Below are the major categories of reputational risk, real-world scenarios, and simple checks you can run early.

A simple way to think about reputational risk

Reputational risk feels messy until you sort it with a few quick questions.

First, separate direct risk from association risk. Direct risk comes from what the company did. Association risk comes from who they work with, who owns them, or who represents them. Both can land on your brand.

Next, look at what happened and how it was handled. A serious incident followed by transparent disclosure and real fixes is different from a company that denies, delays, blames others, then quietly changes the story.

Finally, weigh pattern over a one-off headline. One article can be noise. Repeated allegations, recurring fines, and the same complaint themes over time usually signal a real control problem.

Major reputational risk examples by category

1. Fraud and dishonest business practices

What it looks like: A company inflates performance claims, hides material issues, manipulates reporting, or misrepresents what they are selling. Sometimes it shows up as falsified certifications, misleading case studies, or promises that collapse the moment you ask for evidence.

Why it damages trust: Integrity problems are hard to contain. If they are comfortable deceiving customers, partners, or auditors, it raises the question of what they might do when your contract becomes inconvenient.

What to check first: Start with credible negative news, litigation history, and enforcement actions. Then verify the claims that matter most to your decision, like financial stability, certifications, product performance, or service capacity.

2. Bribery, corruption, and unethical influence

What it looks like: Improper payments, questionable “consulting” fees, aggressive gift and entertainment practices, or a reliance on third-party intermediaries who “make things happen” in high-risk markets. Even when nothing is proven, repeated allegations can create a cloud.

Why it damages trust: Corruption concerns do not stay contained within one company. If regulators, banks, or auditors view the relationship as high-risk, you can inherit compliance exposure and reputational fallout just by being linked.

What to check first: Review adverse media for bribery allegations and related investigations. Ask how they manage third parties, conflicts of interest, and high-risk jurisdictions, and look for signs that compliance is real rather than decorative.

3. Sanctions, AML exposure, and opaque ownership

What it looks like: Hidden owners, complex corporate structures, shell entities, and unexplained links to politically exposed persons. Sometimes the reputational risk is not the brand name you see, but the people behind it.

Why it damages trust: Ownership opacity triggers suspicion for a reason. It can signal attempts to hide conflicts, avoid accountability, or bypass restricted-party controls. Even a small connection to sanctioned parties can become a major brand and compliance crisis.

What to check first: Confirm beneficial ownership and screen relevant parties against sanctions and watchlists. Pay close attention to unusual corporate structures, sudden changes in leadership, and high-risk jurisdictions that do not match the business story.

4. Regulatory violations and repeat non-compliance

What it looks like

Recurring fines, licensing issues, consent orders, or patterns of non-compliance across markets. This can include safety regulators, consumer protection agencies, financial regulators, or industry-specific bodies.

Why it damages trust: A single fine may be a learning moment. Repeated issues suggest weak controls, poor oversight, or a willingness to accept violations as a cost of doing business. That is a reliability problem, not just a legal one.

What to check first: Look for patterns, not just incidents. Review regulator announcements, public enforcement databases where applicable, and whether the company has made meaningful operational changes after prior actions.

5. Data breaches, privacy failures, and weak security

What it looks like: A breach that exposes customer data, ransomware incidents, poor access controls, or a history of quiet disclosures and vague explanations. Privacy failures can also appear as misuse of customer data or non-compliance with data protection expectations.

Why it damages trust: Security incidents can become brand-defining moments, especially when customers feel misled or harmed. The reputational damage often comes from slow disclosure, minimization, or lack of credible remediation.

What to check first: Assess their security posture at a practical level. Ask what data they hold, who can access it, how incidents are reported, and what improvements were made after past events. Also check for public breach reporting and credible coverage in the press.

6. Product failures, safety incidents, and recalls

What it looks like: Defects, safety incidents, repeated quality failures, or product recalls. In services, the equivalent can be systemic delivery failures that create customer harm or consistent broken promises in critical moments.

Why it damages trust: Safety and quality problems are fast-moving headline risks because they feel personal. Even a single incident can trigger scrutiny if the company’s quality controls seem weak or their public response looks evasive.

What to check first: Look for recall history, safety warnings, quality assurance standards, and credible complaint themes. If the relationship affects your customers, ask for evidence of QA processes and how they handle root-cause fixes.

7. Misleading marketing, false claims, and greenwashing

What it looks like: Overstated performance, selective reporting, fake reviews, unverified sustainability claims, or marketing that implies compliance and ethics without real substance. Greenwashing often appears as big claims paired with weak evidence.

Why it damages trust: Once credibility cracks, it spreads. Customers, watchdog groups, and social platforms amplify inconsistencies quickly, and partners can be pulled into the backlash through association.

What to check first: Ask for claim substantiation. Verify certifications and audit results where relevant. Look for watchdog actions, consumer complaints, and repeated accusations of deception.

8. Customer treatment failures

What it looks like: Unfair refund behavior, hidden fees, confusing pricing, predatory policies, and complaint spikes around the same themes. Sometimes it is not a scandal, it is a slow drip of trust loss that accumulates.

Why it damages trust: Customer mistreatment signals a culture problem. It also increases the risk of public backlash and consumer protection attention, especially if the business model depends on tactics that feel exploitative.

What to check first: Review complaint volume and themes across credible sources, including patterns in review platforms and chargeback behavior if relevant. Look for clear terms, fair policies, and whether leadership takes accountability when mistakes happen.

9. Workplace culture scandals

What it looks like: Harassment allegations, discrimination complaints, retaliation against whistleblowers, toxic leadership, and high-profile exits. Culture issues often become public through lawsuits, investigative reporting, and employee narratives online.

Why it damages trust: People risk becomes brand risk fast. It affects hiring, retention, partner confidence, and customer perception, especially when leadership appears dismissive or punitive.

What to check first: Look for consistent themes in credible reporting, court records where accessible, and patterns in employee feedback. Pay attention to how leadership responds, what policies exist, and whether accountability is visible.

10. Labor and supply chain ethics

What it looks like: Forced labor, child labor, unsafe working conditions, excessive subcontracting, or a supply chain that cannot explain where products truly come from. The reputational damage often lands on the downstream brand that sells to the public.

Why it damages trust: Stakeholders increasingly expect traceability. If a supplier’s practices are harmful, your company can be viewed as complicit if you benefit from the output without credible oversight.

What to check first: Ask about supplier audits, traceability, and how they manage tier-two and tier-three suppliers. Look for credible allegations tied to specific regions, industries, or subcontractors, and for evidence of remediation rather than promises.

11. Environmental incidents and community harm

What it looks like: Pollution events, spills, permit breaches, unsafe disposal, or operations that trigger sustained local opposition. Community harm can also include land disputes, health claims, or repeated conflicts with local stakeholders.

Why it damages trust: Environmental controversies can reshape how a brand is perceived for years, particularly when communities feel ignored. The reputational risk grows when companies look like they are prioritizing profit over basic responsibility.

What to check first: Review compliance history, permit issues, and credible reporting on incidents. Look for patterns and evaluate whether their operational controls match the scale of their environmental footprint.

12. Executive misconduct and governance failures

What it looks like: Conflicts of interest, abusive behavior, misuse of funds, coverups, weak board oversight, or leadership that repeatedly “escapes accountability.” Governance failures often show up when the same problem repeats under different labels.

Why it damages trust: Leadership behavior is a reputation multiplier. When the tone at the top looks careless or unethical, stakeholders assume the control environment is weak everywhere else.

What to check first: Look at leadership history, ownership structures, board oversight signals, and whether governance issues appear as recurring patterns across companies or time periods.

13. Crisis mismanagement

What it looks like: The incident happens, then the response becomes the scandal. Deny then admit. Contradictory statements. Quiet edits to prior claims. Attacking critics instead of addressing facts. Slow action paired with polished messaging.

Why it damages trust: Stakeholders often forgive mistakes faster than they forgive manipulation. Poor crisis handling suggests the company lacks transparency, accountability, and operational maturity.

What to check first: Review timelines, public statements, and follow-through. Look for credible independent reporting that compares what was said initially versus what was later confirmed.

14. Third-party association risk

What it looks like: A distributor with a scandal, a supplier accused of unethical practices, an influencer who triggers backlash, or a subcontractor who violates norms in a way that reflects on your brand. The issue may never touch your operations directly, but your name appears alongside theirs.

Why it damages trust: Association risk spreads because stakeholders do not separate brands cleanly. In the public mind, partnership can look like endorsement.

What to check first: Map third parties that are close to your brand. Screen key vendors, partners, and representatives for adverse media, legal disputes, and controversies, then apply escalation rules based on criticality and visibility.

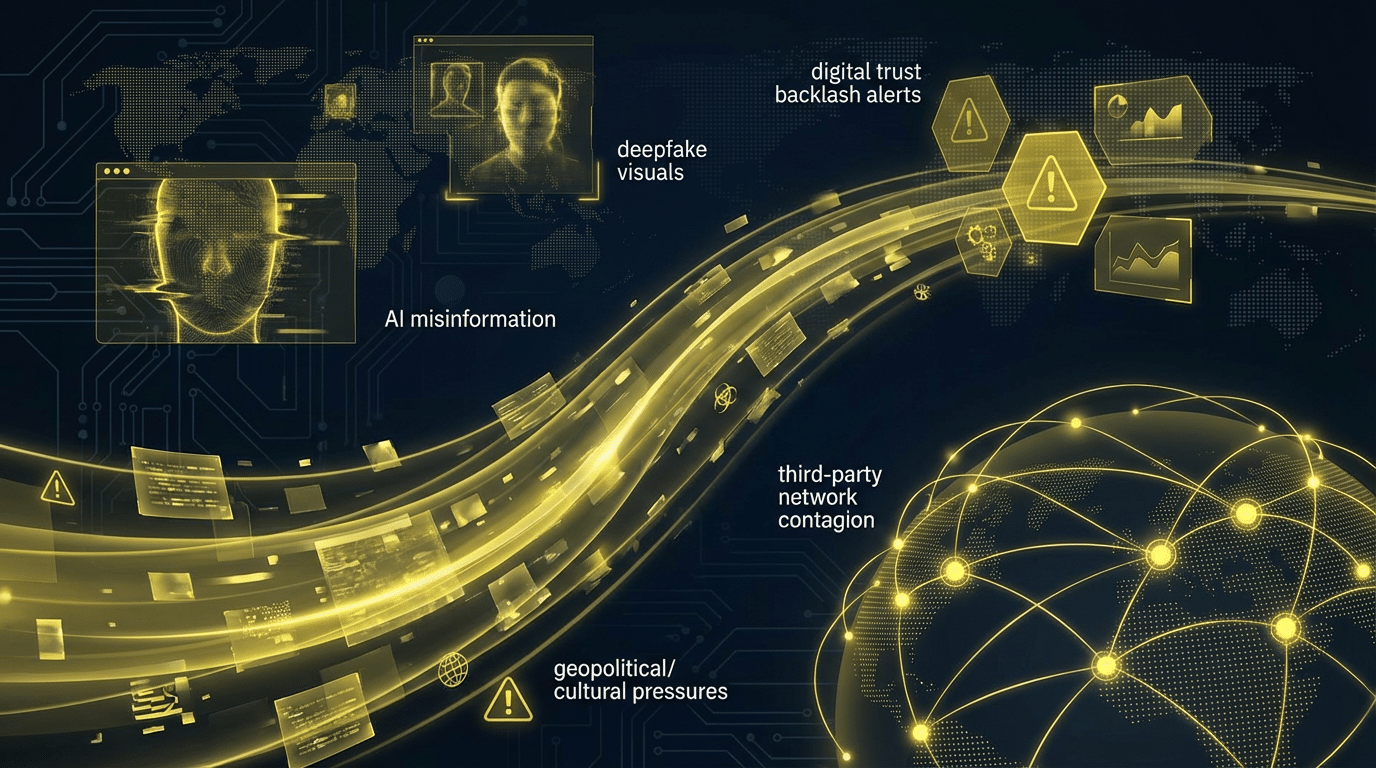

Emerging reputational risks that are changing fast

Trust now moves at the speed of screenshots, clipped video, and algorithms. Some risks are not new, but they travel faster and hit harder.

- AI misinformation and coordinated narrative attacks:** A competitor or activist group pushes a story that is technically misleading but emotionally sticky, and it spreads before facts catch up.

- Deepfakes and impersonation: Fake CEO audio, fake investor calls, or manipulated videos that appear authentic enough to spark headlines, market panic, or employee confusion.

- Digital trust backlash: Stakeholders react strongly to how data is used, how automated decisions are made, and whether systems are biased or unfair, especially when the company cannot explain outcomes clearly.

- Faster third-party contagion: Partner scandals that once stayed local now become global within hours, and brands connected through sponsorships, marketplaces, or shared campaigns get pulled into the same narrative.

- Geopolitical and cultural backlash: Perceived affiliations, donations, partnerships, or market choices trigger boycotts or reputational pressure from communities that interpret actions as values statements.

Quick red-flag checklist for a fast scan

Use this list to decide whether you need a deeper review.

- Repeated negative news over time, not a single isolated mention

- Ownership that is opaque, inconsistent, or difficult to verify

- Recurring regulator actions, fines, or licensing issues

- Credible allegations of fraud, corruption, exploitation, or serious misconduct

- The same complaint theme appearing across many sources

- A history of denying issues, then quietly changing the story later

- Heavy reliance on intermediaries in high-risk jurisdictions with weak transparency

- Prior incidents followed by vague fixes with no evidence of operational change

- Leadership with repeated controversies across roles or companies

- Key suppliers or partners tied to unresolved ethical or legal controversies

- Sudden spikes of identical claims online that feel coordinated

- Contracts, policies, or customer terms that appear designed to trap or confuse

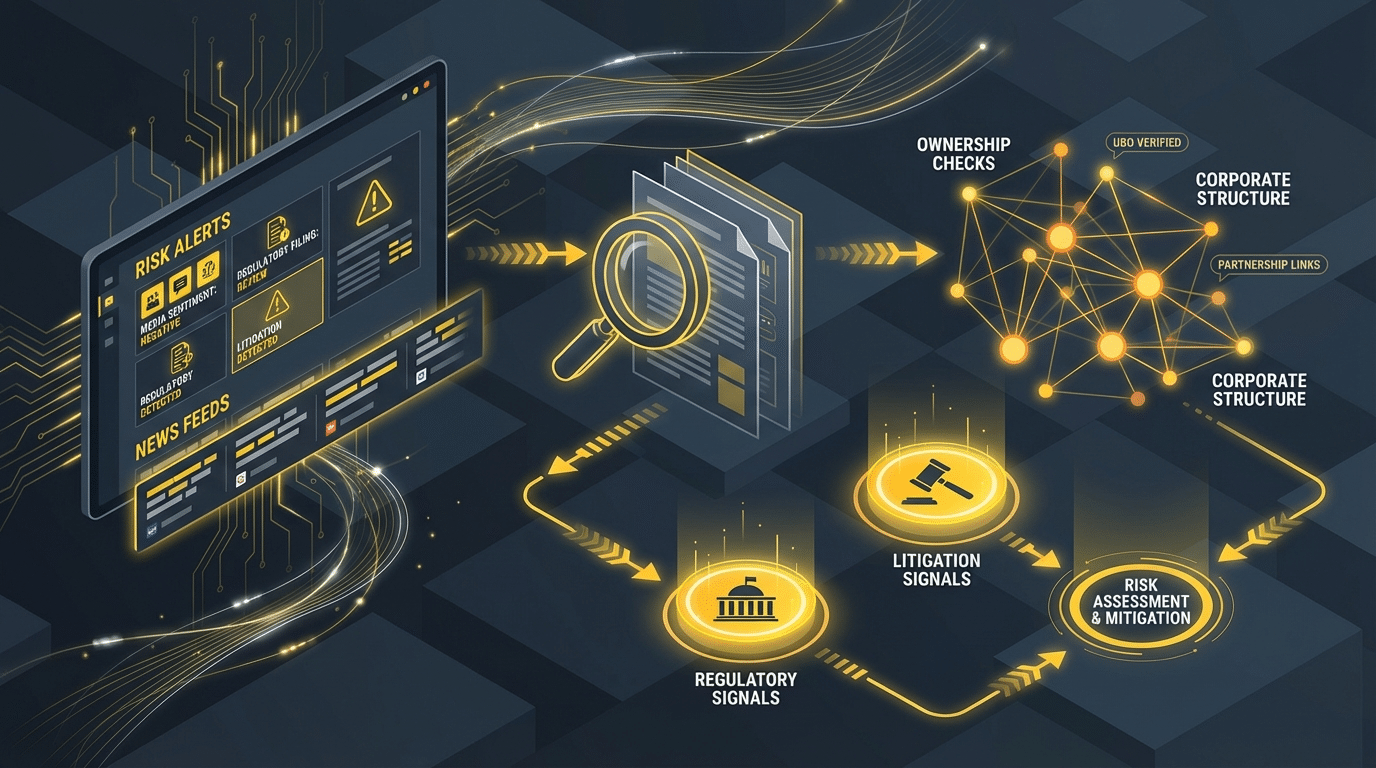

How these examples show up in due diligence

In practice, reputational risk checks start with adverse media and expand into context. The goal is not to collect headlines. The goal is to understand whether there is a credible pattern, what the impact could be, and how close the risk sits to your brand and operations.

A simple workflow is to start with negative news screening, then validate what you find through ownership checks, litigation signals, and regulator history. From there, map what you learn to materiality. Ask how visible the relationship will be, how critical the vendor or partner is, what data or customer impact is involved, and how hard it would be to exit if something changes.

Finally, treat monitoring as part of the decision. Risk changes over time. A relationship that is low-risk today can become high-risk after an acquisition, leadership change, lawsuit, or public controversy.

Ready to sanity-check what you’re seeing?

If a vendor, partner, distributor, or acquisition target is business-critical, reputational risk is not something you want to guess on. A structured review helps you separate noise from real signals, verify what matters, and decide whether to proceed, pause, or add safeguards.

Next step with Rule Ltd: Use a Reputation Risk Assessment to validate the risk and document a clear decision.

FAQs for reputation screening in corporate due diligence

What are the most common reputational risks for companies?

Common ones include fraud allegations, corruption concerns, repeated regulatory violations, data breaches, misleading claims, toxic workplace issues, unethical supply chain practices, and poor crisis handling.

What is adverse media screening?

It is the process of finding credible negative news about a company, its leaders, and its connected parties, then assessing what is material and reliable. It helps you spot controversies and patterns that may not appear in standard financial or operational checks.

How can third parties create reputational risk?

If a vendor, partner, supplier, distributor, or public-facing representative is involved in a scandal, your brand can be pulled into the backlash through association. Stakeholders often assume partnership equals endorsement.

What is the difference between reputational risk and operational risk?

Operational risk is about failures in processes, systems, and delivery that disrupt performance. Reputational risk is about trust and perception, which can be triggered by operational failures but also by ethics, associations, and crisis response.

When should you escalate to enhanced due diligence?

Escalate when the relationship is high-stakes, highly visible, difficult to exit, or involves sensitive data, regulated activities, or major financial exposure. Also escalate when you see repeated allegations, opaque ownership, or patterns of serious misconduct.

How do you monitor reputational risk over time?

Set periodic checks on key counterparties, track major ownership and leadership changes, and monitor adverse media for new developments. The goal is early awareness so you can respond before an issue becomes a surprise.