Reputational risk in corporate due diligence is the risk that working with a company damages trust in your business, because stakeholders form a negative view of who you are linked to. That perception can turn into real harm, such as lost deals, stricter scrutiny, customer churn, talent issues, or higher costs to fix problems.

In due diligence, you assess this by checking whether the counterparty shows credible, repeated signals of misconduct or harmful impact. That can include fraud, corruption, serious complaints, labor issues, environmental harm, or other controversies. The key question is whether the risk is close enough to your brand or operations to matter.

Why reputational risk belongs inside corporate due diligence

Reputational risk is not only a communications issue. It is a decision risk. If questions come later, you need to explain why you proceeded, what you checked, and what evidence supported the call.

Corporate due diligence gives you that structure. It helps you verify the counterparty, map ownership and control, and document the signals that matter. It also keeps decisions consistent across vendors, partners, distributors, and targets, instead of relying on gut feel.

A risk-based approach is also practical. You do not need the same depth for every relationship. You need the right depth for the risk you are taking.

Common triggers and red flags to look for

Use this list as a quick filter. Each item is a reason to slow down and verify.

- Repeating adverse media from credible sources

- Regulatory enforcement, fines, or ongoing investigations

- Ownership opacity, nominee patterns, or unclear control

- Sudden ownership or leadership changes with no clear explanation

- Persistent complaints that suggest a pattern, not a one off

- ESG controversies that conflict with your standards or customer expectations

- Corruption indicators, especially where intermediaries represent you

- Inconsistent company facts across sources, such as names, addresses, or directors

- Sanctions proximity, even without a direct match

A red flag does not always mean stop. It means verify, document, and decide with intent.

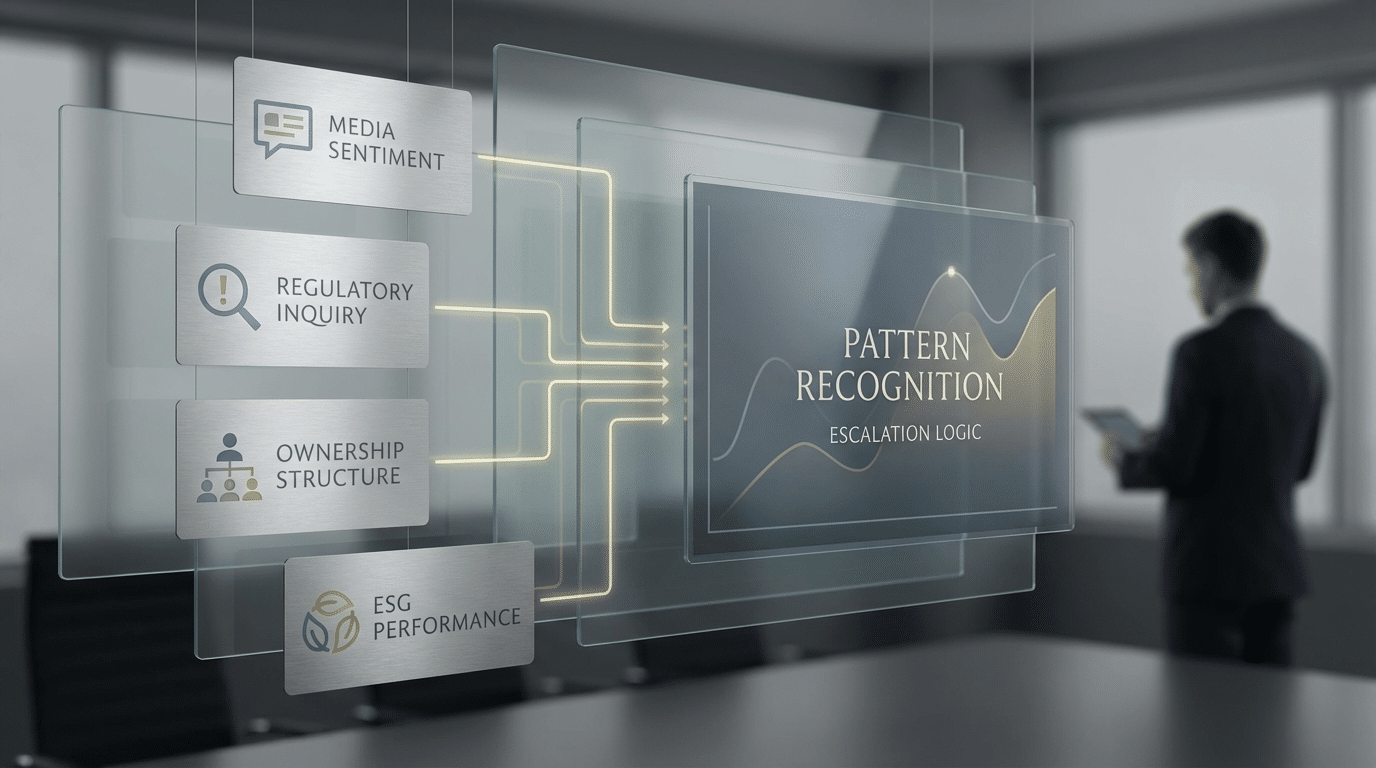

How to assess reputational risk in practice

You do not need a complex scoring model. You need a repeatable method that your team can follow.

- Define the relationship: Write what the counterparty will do, and how visible it will be.

- Separate claims from outcomes: List what is alleged, what is proven, and what is unresolved.

- Judge source quality: Prefer regulators, court records, and reputable publishers.

- Test for patterns: Look for repetition, escalation, and the same theme across sources.

- Decide and document: Record what you found, why it matters, and what you chose to do next.

When to escalate to enhanced review

Escalate when verification is hard, or the downside is high. Use a clear trigger list so decisions stay consistent.

- Ownership is unclear or keeps changing

- Negative signals repeat across credible sources

- There is regulatory enforcement or active investigation activity

- There is a sanctions exposure or unclear proximity

- The counterparty represents you, such as an agent or distributor

- The contract is large, long-term, or hard to unwind

- The counterparty refuses basics or delays the evidence

A simple rule works in most cases. If you cannot verify the story with credible evidence, escalate.

How Rule Ltd can help

Rule Ltd provides practical reputational risk assessments that fit into corporate due diligence decisions. The focus is clarity, documented rationale, and a scope that matches your risk tolerance.

What Is Reputational Risk in Corporate Due Diligence FAQs

What is reputational risk in simple terms?

It is the risk that association with another party harms trust in your business.

What is the difference between reputational risk and reputational damage?

Reputational risk is exposure before a decision. Reputational damage is harm after trust drops.

What are common reputational risk examples in third party relationships?

Fraud allegations, corruption concerns, recurring serious complaints, or harmful labor or environmental practices.

How does adverse media screening reduce reputational risk?

It surfaces negative signals early so you can verify facts before you commit.

Can reputational risk exist even if nothing illegal happened?

Yes, stakeholder reaction can create real impact without illegality.

When should reputational risk trigger enhanced review?

When signals repeat, sources are credible, ownership is unclear, or evidence is hard to verify.