Corporate due diligence helps you reduce surprises before you commit. This guide gives you a quick way to decide when you need it and how deep it should go.

What is corporate due diligence

It is different from a quick background check. A real corporate due diligence review uses reliable sources to confirm the company’s details and who controls it. It also screens for common risk signals like sanctions exposure, adverse media, litigation patterns, and regulatory issues. The outcome is a clear risk picture you can use to approve, escalate, renegotiate, or walk away.

Corporate due diligence is used in M&A, but it is also used for vendor onboarding, partnership approval, distributor checks, and other third-party risk decisions.

Corporate due diligence is a structured review of a company to verify its identity, ownership, and risk exposure before a deal or partnership. It helps reduce legal, reputational, and operational surprises by checking facts about the counterparty.

When do you actually need corporate due diligence?

Here are the most reliable triggers. If several apply, you should treat it as a due diligence moment.

- You are entering a new geography or dealing cross border

- The third party represents you, such as agents, resellers, introducers, or intermediaries

- The contract value is large, the term is long, or the supplier is operationally critical

- Ownership or control looks unclear, layered, or constantly changing

- Your brand is reputation sensitive, or your customers are regulated

- You are being pressured to sign fast while details are incomplete or inconsistent

Scenario to action matrix

| Scenario | What can go wrong | Recommended depth |

| New vendor for a non critical service | Low operational impact, smaller financial exposure | Standard |

| Critical supplier for delivery, security, or core ops | Disruption risk, compliance exposure, cascading customer impact | Enhanced when risk signals appear |

| Distributor, agent, reseller, introducer | Bribery or misconduct risk, reputational damage through association | Enhanced |

| Cross border partner in a higher risk region | Sanctions exposure, weak enforcement, opaque ownership | Enhanced |

| Joint venture or long term strategic partnership | Shared liability, governance risk, hard to unwind | Enhanced when structure is complex |

| Acquisition target or investment | Hidden litigation, regulatory issues, ownership problems | Standard plus deeper workstreams as needed |

| Counterparty connected to public sector spending | Political exposure risk, heightened scrutiny | Enhanced |

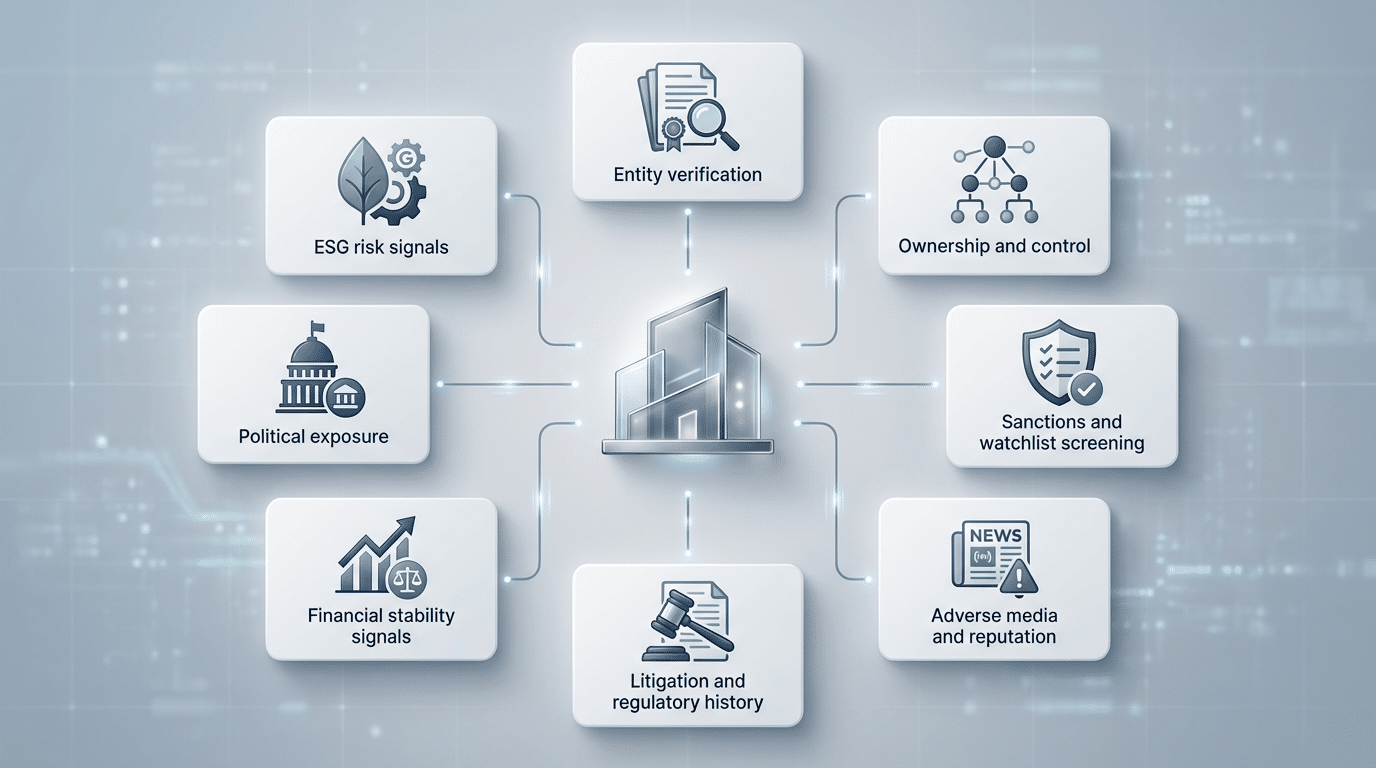

What corporate due diligence typically includes

Most scopes fit into the categories below. You can tailor the depth based on risk, but this is the baseline map buyers expect.

1. Entity verification

This confirms the company exists and is operating as claimed. It checks basics like legal name, registration status, dates, addresses, and jurisdictions. This step often surfaces early inconsistencies.

2. Ownership and control

This maps ownership and control so you understand who ultimately sits behind the entity. It looks for beneficial ownership signals, shareholder chains, and corporate structure. It matters most when the setup has layers.

3. Sanctions and watchlist screening

This screens the entity and relevant associated parties against sanctions lists and watchlists. It helps you avoid prohibited relationships and spot issues that need deeper verification.

4. Adverse media and reputational exposure

This looks for credible negative reporting and reputation signals tied to the company and key principals. The goal is to identify patterns you can document, not rumor.

5. Litigation and regulatory history

This checks for dispute patterns, enforcement actions, and regulatory issues that affect trust, compliance, or business continuity. One dispute is not always a deal breaker. Repeated themes are more serious.

6. Financial stability signals

This is not full financial due diligence. It can still flag issues that affect reliability and contract risk, such as distress indicators, unusual restructuring, or public warning signs.

7. Political exposure

This matters more when there is public sector involvement, sensitive industries, or higher corruption risk environments. It helps you understand scrutiny risk and association risk.

8. ESG risk signals

When ESG matters to customers, regulators, or internal policy, this can flag consistent controversies or governance concerns that create reputational exposure.

Standard vs enhanced due diligence

Standard due diligence is baseline verification and screening. It confirms the entity, maps ownership where possible, and checks the most common exposure areas.

Enhanced due diligence goes deeper when the risk is higher or harder to verify. It expands verification, increases source coverage, and focuses on what could realistically cause harm.

When enhanced due diligence makes sense

Enhanced due diligence is usually the safer choice when one or more of these are true.

- Higher risk jurisdiction or sector

- Ownership and control are unclear, layered, or frequently changing

- Credible negative media exists, or there is a repeating pattern

- Regulatory signals, enforcement actions, or recurring dispute themes appear

- The third party represents you or interacts with customers on your behalf

- The transaction is large, long term, or difficult to unwind

- Screening results require careful verification and documentation

Red flags that should make you pause

A red flag does not always mean stop. It means verify and document before you proceed. The biggest mistakes happen when teams notice signals but keep moving without clarifying the facts.

These are the red flags that most often deserve a pause.

- Company details conflict across credible sources

- Ownership is unclear, or changes suddenly without explanation

- The footprint looks thin for the size of the claims

- Directors or principals show up across many unrelated entities with limited transparency

- Repeated litigation themes, not just one dispute

- Consistent negative reporting from reputable sources

- Refusal to share basic information needed to verify identity and control

- Extreme urgency combined with shifting or incomplete answers

When a red flag appears, tighten the question. What exactly must be verified, and what evidence would change the decision.

What to prepare before you run due diligence

A little upfront information makes due diligence faster and more accurate. It also keeps the review focused on the real risk.

Gather the basics below.

- Full legal entity name and any trading names

- Registration number and jurisdiction

- Known owners, directors, and key executives

- Purpose of the relationship, such as vendor, acquisition, partnership, distributor

- Expected transaction size, contract duration, and operating geography

- Any internal concerns already known, and why this review is being requested

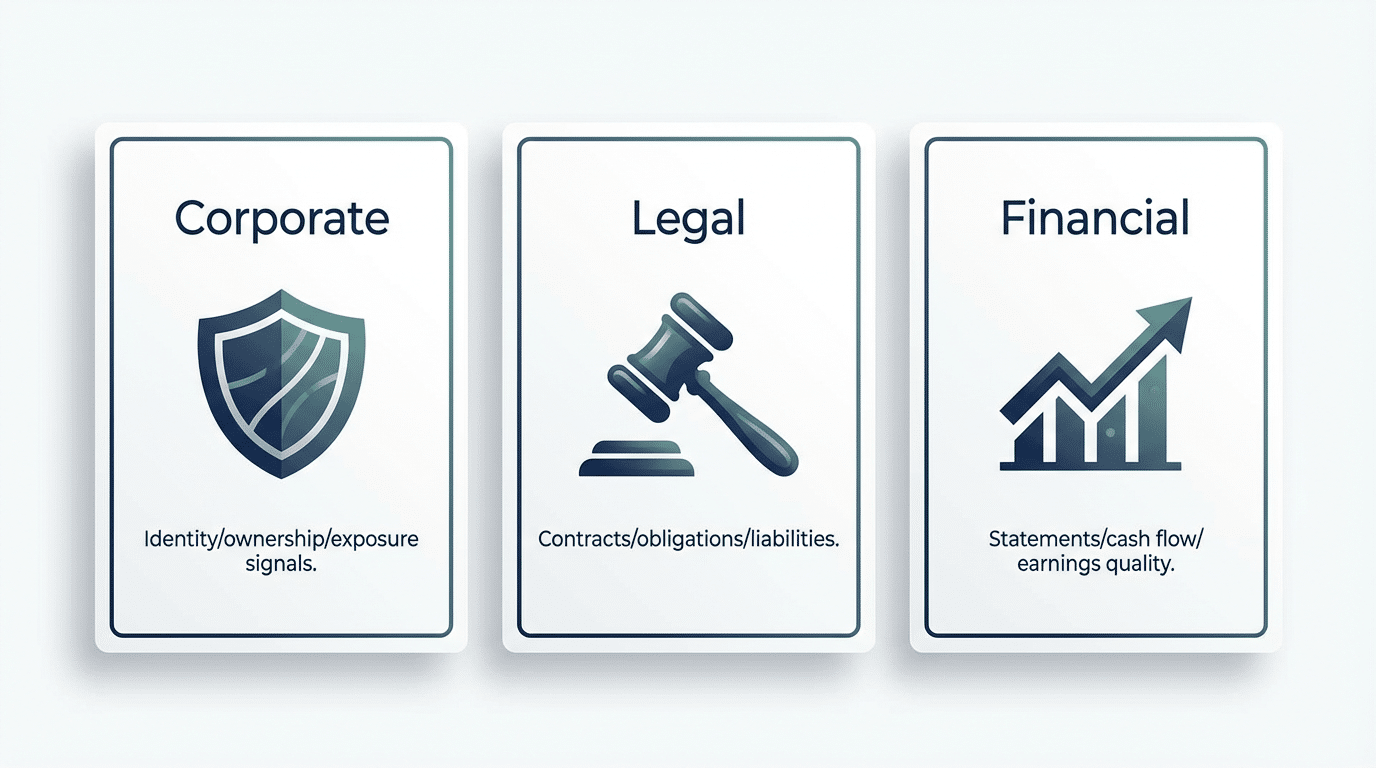

Corporate vs legal vs financial due diligence

Corporate due diligence focuses on integrity, structure, and exposure risks. It answers who you are dealing with, who controls them, and what signals suggest reputational or compliance risk.

Legal due diligence focuses on legal obligations and liabilities. It looks at contracts, disputes, compliance obligations, and legal exposures that sit inside the relationship.

Financial due diligence focuses on financial health and performance. It looks at financial statements, cash flow, liabilities, and the quality of earnings where relevant.

In practice, corporate due diligence often comes first because it tells you whether the counterparty is safe to move forward with at all, before you invest time in deeper workstreams.

Corporate due diligence is the decision tool you use when the cost of being wrong is high. It helps you verify the entity, understand ownership and control, and identify exposure signals like sanctions risk, adverse media, litigation patterns, and regulatory concerns. When relevant, it can also cover political exposure and ESG risk signals.